Nobody wants to think about the worst case scenario for their cruise vacation. As much as we'd all like to believe that it is smooth sailing as soon as the deposit is placed, that is not always the case. Unexpected events, such as the sudden onset of an illness prior to embarkation or a delayed flight, can cause the vacation to be thrown off course.

Having travel insurance ensures that you will be covered if things don't go as planned, such as medical emergencies, travel delays, or other unpredictable events.

You may not want to shell out the additional money to cover events that may never happen, but here's a breakdown of what cruise travel insurance is and why you should always purchase it.

What is cruise travel insurance?

Each cruise line has their own version of travel insurance that guests can pay extra for. It provides coverage for things like travel delays, medical emergencies, and luggage mishaps. Plus, you'll often receive 24/7 access to a dedicated hotline to assist you while traveling.

The purpose of travel insurance is meant to provide peace of mind in the event that something unfortunate does occur while on vacation, and you can expect the pricing to be between 6-15% of your total cruise fare.

Some cruise lines, like Royal Caribbean International, Carnival Cruise Line, and Norwegian Cruise Line, have even implemented trip cancellation clauses that allow you to cancel your cruise vacation and receive a certain amount back in the form of future cruise credit credits or cash.

Of course, it's important to be aware of the terms of your specific insurance policy, as certain reasons are eligible for a full refund, while others only allow you to receive a certain percentage back as a future cruise credit.

Read more: Should you buy annual travel insurance plans?

What's covered with a cruise insurance policy?

Policy coverage varies from cruise line to cruise line, but here's the minimum of what you can expect with each mainstream line.

Carnival Cruise Line

Carnival Cruise Line insurance is underwritten by Nationwide Mutual Insurance Company. Unfortunately, it is not available to residents who live in Quebec, Canada; New York; or Puerto Rico.

On a few mock bookings I priced out, I found that pricing ranged from $49 per person for a 3-night Bahamas cruise, to $95 per person for a 5-night Western Caribbean cruise, and $120 per person for a 7-night Alaska cruise. The longer the sailing, the more expensive the vacation is, and the more you can expect the insurance policy to be.

You'll receive the following benefits if you opt to purchase travel insurance through Carnival Cruise Line:

- Trip Interruption Protection: You can get reimbursed up to the total cost of the cruise if you must start your vacation late or need to come home early due to illness, injury and more.

- Baggage Protection: The insurance policy will reimburse you up to $1,500 if your baggage is lost, stolen or damaged, and up to $500 to buy necessary items if your bags are delayed over 24 hours.

- Medical Protection: Up to $10,000 if you get sick or injured on your vacation.

- Emergency Evacuation: Up to $30,000 for emergency medical evacuation and repatriation (services provided by LiveTravel).

Celebrity Cruises

Celebrity offers CruiseCare, which is administered by Aon Affinity and underwritten by Arch Insurance Company. Like Carnival Cruise Line, it is not offered to guests who reside in the state of New York; however, these passengers may enroll directly through Aon Affinity.

A quick search on Celebrity' website revealed a few different prices of CruiseCare varying from $148 for a 4-night Key West & Bahamas cruise to $228 for a 7-night Greece and Croatia cruise.

You'll receive the following benefits if you opt to purchase travel insurance through Carnival Cruise Line:

- Trip Interruption Protection: You can get reimbursed up to 150% of the total trip cost if you can't start or finish your cruise vacation because you are sick or hurt, there's a death in the family, or another covered reason.

- Trip Delay: Up to $2,000 for catch-up expenses.

- Accident and Sickness Medical Protection: Up to $25,000 if you get hurt on your cruise and up to another $25,000 if you get sick.

- Emergency Medical Evacuation: Up to $50,000 if you need emergency medical transportation.

- Baggage Protection and Delay: The insurance policy will reimburse you up to $1,500 if your baggage is lost, stolen or damaged, and up to $500 to buy necessary items if your bags are delayed.

Disney Cruise Line

When finalizing your Disney Cruise Line vacation, you will have the option to add the Disney Cruise Line Vacation Plan, which is underwritten by Arch Insurance Company with a 24-hour helpline through CareFree Travel Assistance.

I went to Disney Cruise Line's website to price out a few different itineraries to see how much their insurance would be and found that the vacation plan for a 7-night Eastern Caribbean cruise that cost $4,858 can be purchased for $388.64, and the plan for a 3-night Bahamas cruise that cost $2,550 was $204.

Therefore, it appears that the Disney Cruise LIne Vacation Plan costs 8% of the total cruise fare before taxes, fees, and gratuaties.

The insurer will reimburse up to the following limits:

- Trip Cancellation and Interruption: You can get reimbursed up to the total trip cost ($20,000 limit) if you cancel or are interrupted due to sickness, injury, death, or other covered reason.

- Trip Delay: Up to $500 if your cruise is delayed 6+ hours due to carrier-caused delays, including weather, unannounced strikes, and more.

- Accident and Sickness Medical Protection: Up to $20,000 to cover medical treatment, hospitalization, and more if you become sick or injured on the cruise.

- Emergency Medical Evacuation/Repatriation: Up to $30,000 if you need emergency medical transportation.

- Baggage Loss and Delay: Up to $3,000 if your baggage is lost, stolen or damaged, and up to $500 to buy necessary items if your bags are delayed for over 24-hours.

Holland America Line

With Holland America Line, you can purchase Cancellation Protection starting at only $79, which will allow you to cancel your cruise for any reason and receive a refund of up to 80% of your total cruise fare. If you upgrade to the Platinum Plan, you will receive additional refunds, worldwide emergency assistance, and more.

It is important to note that the Standard Plan does not include trip interruption or delay, protection for baggage and other personal effects, baggage delays, emergency medical evacuations/repatriation, medical/dental expenses, or worldwide assistance. It is, however, available to guests in all states, while the Platinum Plan is not available to residents of Quebec, Canada; New York; or Puerto Rico.

The Platinum Plan resembles travel plans offered by other cruise lines:

- Trip Interruption: You can get reimbursed up to 150% of the total trip cost.

- Trip Delay: Up to $500.

- Baggage/Personal Effects: Up to $1,000.

- Bagge Delay: Up to $500.

- Emergency Evacuation/Repatriation: Covers up to $50,000.

- Medical/Dental: Up to $10,000 to cover medical and dental treatments.

When looking at various sailings on their website, I found that the Standard Plan for a 7-night Alaska cruise that came to $2,058 total for two guests before taxes, fees, and gratuities was $119 per person and Platinum was $149 per person. That equates to about 5.80% and 7.25% of the cruise fare, respectively.

MSC Cruises

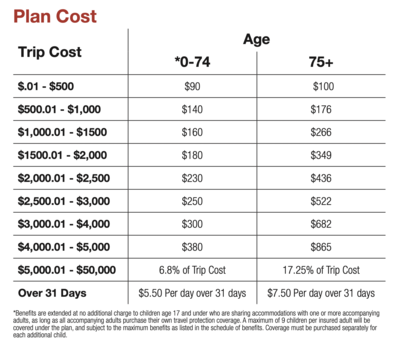

MSC Cruises' insurance is administered by Customized Services Administrators, Inc. via Generali Global Assistance. Per their website, the policy's pricing is dependent on the guests ages, as well as total cost.

A guest who is 25 and spent $1,200 on their vacation would be charged $180 for insurance, while someone over the age of 75 would be charged nearly $100 more, or $266.

It is important to note that travel insurance benefits are extended to children 17 and under who are sharing a room with one or more adults who purchased a travel insurance plan.

When it comes to coverage, they provide a minimum and maximum of what the policy will cover per plan holder:

- Trip Cancellation and Interruption: 100% of the trip cost insured.

- Travel Delay ($200 per day): Minimum of $600 and maximum of $6,000.

- Medical and Dental Coverage: Minimum of $25,000 and maximum of $100,000.

- Emergency Assistance and Transportation ($10,000 emergency companion hospitality expenses): Minimum of $50,000 and maximum of $500,000.

- Baggage Coverage: Minimum of $1,000 and maximum of $10,000.

- Baggage Delay: Minimum of $100 and maximum of $1,000.

- Accidental Death & Dismemberment/Air Flight Accident: Minimum of $25,000 and maximum of $250,000.

Norwegian Cruise Line

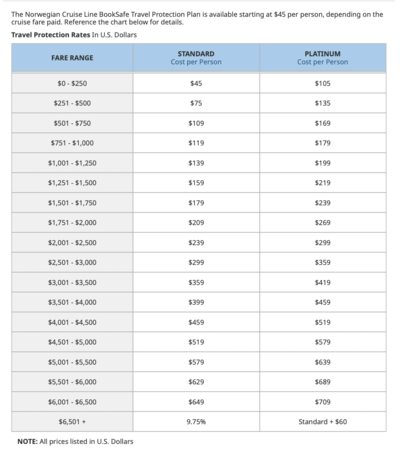

BookSafe Travel Protection Plan is the insurance program offered by Norwegian Cruise Line underwritten by Nationwide Mutual Insurance Company.

They offer three different plans for guests to choose from: Standard, Platinum, and Essentials, with the cheapest plan starting at $45 per person.

Someone wanting to purchase the Platinum Plan and spent $975 on their cruise would be subject to an additional $179 for insurance.

If you get the Standard Plan, you can expect the following benefits:

- Trip Cancellation: Reimbursement if you need to cancel your trip for a covered reason, with a cash refund of up to 100% of the total cost of the trip.

- Trip Interruption: Reimbursement if you need to interrupt your trip for a covered reason, with cash refund up to 150% of the trip's total cost.

- Trip Delay: Reimbursement of up to $500 for catch-up expenses (i.e., meals and hotels) if you are delayed getting to or from your trip.

- Accident Medical/Sickness Medical: Reimbursement of up to $20,000 if you get sick or injured on your trip.

- Emergency Evacuation: Coverage of up to $25,000 if you need emergency medical transportation

- Repatriation: Coverage of up to $5,000 for the shipment of remains in the event of death during the trip

- Baggage Loss and Delay: Reimbursement of up to $1,500 if your things are lost, stolen or damaged and up to $750 if your bags are delayed 24+ hours and you need to purchase necessary items.

The most notable differences between the Standard and Platinum Plans are the increased coverage amounts in regard to emergency evacuation, repatriation, and baggage loss. Plus, the future credit given if you need for any reason is increased from 75% to 90%.

- Emergency Evacuation: Coverage of up to $50,000 if you need emergency medical transportation

- Repatriation: Coverage of up to $10,000 for the shipment of remains in the event of death during the trip

- Baggage Loss and Delay: Reimbursement of up to $3,000 if your things are lost, stolen or damaged and up to $750 if your bags are delayed 24+ hours and you need to purchase necessary items.

The Essentials Plan is identical to the Standard Plan except it does not include trip cancellation and interruption protections.

Princess Cruises

If you are sailing with Princess Cruises, you might be debating on whether or not you should purchase Princess Vacation Protection, which is underwritten by Nationwide. Recently, they improved the plan to offer guests even more peace of mind.

The pricing for the Princess Vacation Protection plan is simple. The Standard Plan is 8% of the cruise's cost, while the Platinum Plan is 12%.

The Standard Plan helps protect your travel investment against the unexpected in the following ways:

- Trip Interruption: Reimbursement if you need to interrupt your trip for a covered reason, with a cash refund up to 150% of the total cruise vacation cost

- Trip Delay: Reimbursement of up to $500 pre-cruise and $1,500 post-cruise (with a maximum of $1,500 in the event there's a delay both before and after the cruise) for catch-up expenses if you are delayed getting to or from your trip.

- Accident Medical Expense: Reimbursement of up to $10,000 if you get hurt on your trip.

- Sickness Medical Expense: Reimbursement of up to $10,000 if you get sick on your trip.

- Emergency Evacuation/Repatriation: Coverage of up to $50,000 for the shipment of remains in the event of death during the trip

- Baggage Loss/Delay: Reimbursement of up to $1,500 if your things are lost, stolen or damaged and $750 if your bags are delays 24+ hours and you need to purchase necessary items.

If you are stuck between choosing the Standard and Premium Plan, the Premium offers expanded protections in the event of accidental medical or sickness emergencies, as well as emergency evacuations and repatriations and baggage loss.

- Trip Interruption: Reimbursement if you need to interrupt your trip for a covered reason, with a cash refund up to 150% of the total cruise vacation cost

- Trip Delay: Reimbursement of up to $500 pre-cruise and $1,500 post-cruise (with a maximum of $1,500 in the event there's a delay both before and after the cruise) for catch-up expenses if you are delayed getting to or from your trip.

- Accident Medical Expense: Reimbursement of up to $20,000 if you get hurt on your trip.

- Sickness Medical Expense: Reimbursement of up to $20,000 if you get sick on your trip.

- Emergency Evacuation/Repatriation: Coverage of up to $75,000 for the shipment of remains in the event of death during the trip

- Baggage Loss/Delay: Reimbursement of up to $3,000 if your things are lost, stolen or damaged and $500 if your bags are delays 24+ hours and you need to purchase necessary items.

Royal Caribbean International

Royal Caribbean only offers one tier of travel insurance that's underwritten by Arch Insurance Company. And, again, if you are a resident of New York State, insurance directly through Royal Caribbean is not available to you.

- Trip Interruption: Up to 150% of total trip cost if you can't start or finish your cruise vacation because you're sick or hurt, there's a death in the family or another covered reason.

- Trip Delay: Up to $2,000 for catch-up expenses

Accident and Sickness Medical: up to $25,000 if you get hurt and $25,000 if you get sick on your cruise vacation. - Emergency Medical Evacuation: Up to $50,000 if you need emergency medical transportation during your vacation.

Baggage Protection and Delay: Up to $1,500 if your bags are lost, stolen, or damaged and up to $500 to buy necessary personal items if your bags are delayed.

Insurance for a 7-night Caribbean cruise for two totaling $2,762 (before taxes, fees, and gratuities) offers insurance for $218.

In comparison, a 7-night Alaska cruise for two that comes to $1,002 before takes, fees, and gratuities, has additional insurance listed to purchase for $118.

Why do you need cruise vacation protection?

While travel insurance may seem like an additional fee you need to factor into your vacation budget, it is meant to provide peace of mind in case anything unexpected occurs before, during, or even after your trip and protect you against any major financial losses.

If, for instance, your flight gets delayed and you miss the ship's departure, travel insurance plans will help cover some of the associated costs of meeting up with the ship at the first port of call.

Additionally, many passengers partake in active activities while on a cruise, such as jet-skiing, zip lining, and horseback riding. All active activities come with a risk, and you simply cannot predict if you'll need medical attentional due to an accident on the ship or in port.

You've paid for your vacation, the last thing you want to do is be out the funds due to an unpredictable event!