Although it might not seem important, travel insurance is a must when embarking on a cruise vacation. A good insurance plan provides peace of mind in case of unexpected medical emergencies at sea.

One guest learned just how expensive cruise ship medical centers can be on a recent voyage aboard Norwegian Escape.

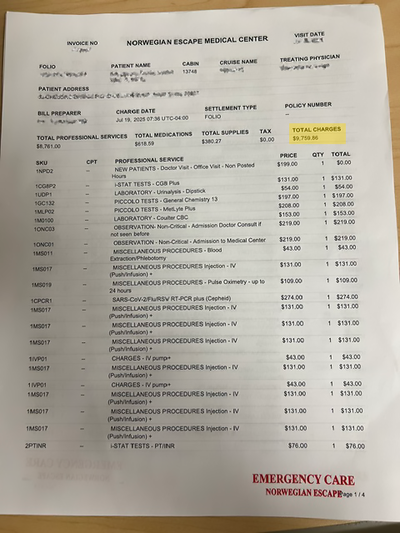

In a post titled, "Don't get sick on a cruise ship," ultranothing shared the breakdown of their $9,756.86 medical bill they were slapped with.

$8,761 was spent on "professional services," while the cost of medication totaled $618.59. Finally, they were billed $380.27 for supplies. But don't worry, they were not charged anything for the tax!

The bulk of the charges (more than 89%) came from professional services. This category covered things like the new patient office visit, IV injections, observations, i-STAT tests, and more.

According to the bill, the passenger was charged on July 19, 2025. Norwegian Escape was on the final day of a 7-night cruise to the Western Caribbean, calling at Roatán, Harvest Caye, Cozumel, and Great Stirrup Cay.

"Travel health insurance is a thing"

The point of travel insurance is to be protected during an emergency, whether a medical crisis, trip interruption, or other unforeseen travel complication.

Most standard medical insurance policies don't cover international treatment, making a separate travel insurance policy even more necessary for cruise vacations.

With the right insurance policy, many costs incurred in the onboard medical center can be reimbursed, preventing you from spending your hard-earned money on something as simple as a stomach bug or UTI.

Many users on ultranothing's post emphasized the importance of travel insurance. Some even gave scenarios of when it was useful to them.

"I was in a bike wreck in Mexico. Where I was, a private hospital was available and care was exceptionally good. As soon as they realized that I wasn't going to die, they wanted a credit card. Hospital costs, ambulance ride, xrays, etc totaled about $2000," explained Cute_Reflection_9414.

"I had to pay prior to being discharged. Manually submitted to insurance and I was reimbursed for everything except the normal $50 copay."

Another added, "My neighbor had to be airlifted off a cruise ship the other year. Fortunately she is a ‘veteran cruiser’ and carries enough insurance to mitigate the diabolical costs."

Not the first time a cruiser has been hit with a large medical bill

Not investing in travel insurance has to be one of the biggest mistakes you can make when planning a cruise. Without it, you could walk away spending far, far more money than you anticipated.

For example, one couple had to pay $10,000 in services received in the cruise ship medical center because they didn't have travel insurance. They shared their lesson in the now-deleted Reddit post titled, "Appendix burst on honeymoon!"

The Reddit user explained how they were on a cruise to the Bahamas when they began suffering from severe and sudden stomach pain.

"The medical center was closed and they had an 'emergencies only' line. I waited 4 hours before calling because I couldn't tell if it was an emergency," they explained, "Not only did I have appendicitis, [but] my appendix ruptured. This is very serious and I will be in the hospital for at least a week."

Because of the severity of the situation, they had to disembark the cruise early for emergency surgery that could not be performed onboard.

Another couple ended up in the medical center on their sailing aboard Royal Caribbean's Independence of the Seas.

Vincent Wasney was with his fiancée, Sarah Eberlein, when he began suffering from a series of seizures. Before the cruise ended, they were given a bill totaling over $2,500 for general and enhanced observation, a blood test, anticonvulsant medicine, and a fee for the services performed outside the medical facility.

Read more: Man was sick on a cruise and was hit with a big bill before being sent home