Travel insurance is important for more than just protecting against lost luggage or flight delays, especially for trips like cruises.

A good insurance plan can provide peace of mind in case of unexpected medical emergencies at sea. One couple learned the hard way when they embarked on their honeymoon cruise, only to have their dream vacation become a headache due to a sudden medical issue.

They shared the valuable lesson they learned on the r/cruise Reddit thread. In a post titled, "Appendix burst on honeymoon!" user jellocore recounted how they were on a cruise to the Bahamas when they began suffering from severe and sudden stomach pain.

"The medical center was closed and they had an 'emergencies only' line. I waited 4 hours before calling because I couldn't tell if it was an emergency," they explained, "Not only did I have appendicitis, [but] my appendix ruptured. This is very serious and I will be in the hospital for at least a week."

Despite the hiccup in their celebration, jellocore expressed gratitude for the ship's doctors and nurses, claiming they were "phenomenal" and they felt "very cared for."

Unfortunately, the newlyweds had only been onboard for two days before the medical crisis unfolded, so they had to disembark early for emergency surgery.

"Always buy travel insurance"

The couple didn't anticipate their honeymoon being so eventful, so they neglected to purchase travel insurance. However, the point of insurance is to be protected during an emergency, whether a medical crisis, trip interruption, or other unforeseen travel complication.

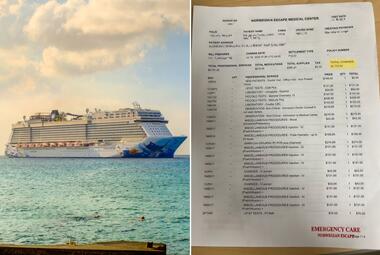

Their mistake was costly. "Not only are we out our entire honeymoon budget, [but our savings have also] been wiped clean as the [doctor's] bill was over $10k," jellocore said. They added that the $10k bill was just for the ship's medical center—their health insurance policy covered the hospital stay in Miami.

If they had a travel insurance policy with a medical clause, many of the costs associated with their onboard treatment would have been reimbursed, preventing them from draining their personal savings account.

Many comments emphasized the importance of travel insurance, using jellocore's experience as a reminder of the unpredictable nature of travel

"Wishing you a speedy recovery. Always a great reminder to get travel insurance. Make sure you get an itemized bill and maybe you can get some reimbursed through your regular medical insurance. Also make sure to see if you can get dr’s notes proving you were sick," said meretap1127.

bends_like_a_willow wrote, "I’m glad you’re okay and sorry you had to learn an expensive lesson. Hopefully others learn from your mistake! Travel medical is NOT optional."

"Damn, nice to hear you’re okay and were taken good care of. If this post doesn’t spell out 'Get Medical Insurance When You Travel', I don’t know what would," exclaimed squirrelcop3305.

Another couple was hit by a big medical bill

While cruising on Royal Caribbean's Independence of the Seas, a similar incident happened to Vincent Wasney and his fiancée, Sarah Eberlein. After suffering from a series of seizures, the couple had to pay over $2,500 in medical bills for services that Wasney received onboard since they didn't have travel insurance.

The bill included general and enhanced observation, a blood test, anticonvulsant medicine, and a fee for the services performed outside the medical facility. The most expensive billable item was the general ward admission and observation, totaling $2,285.78. The i-STAT blood test, out-of-facility services, and medication cost $97.99, $104.55, and $11.90, respectively.

Wasney was evacuated by rescue boat since the ship was close to Florida's coast and then transported to the emergency room at Broward Health Medical Center via ambulance, which was an additional expense.

Read more: Man was sick on a cruise and was hit with a big bill before being sent home

Because of the high cost of medical care on cruise ships, some cruisers may hesitate to receive treatment

Even with travel insurance, you must be prepared to pay the total cost upfront. Once on land, you can file a claim with your insurance company to be reimbursed. Recently, a passenger onboard a Royal Caribbean cruise refused treatment for an allergic reaction because of the price.

The guest shared a video on TikTok revealing her swollen face, explaining how she was told Benadryl from the ship's medical center would cost nearly $400, though she does not disclose whether this cost also included a consultation with the doctor onboard.

Unfortunately, the onboard stores didn't have any medication available; however, she managed to get Benadryl from another passenger and avoided paying for treatment from the medical center.

The passenger's circumstance highlights the importance of coming prepared. Before your cruise, stock up on common over-the-counter medications like Benadryl, pain relievers, cold & flu medication, eye drops, Neosporin, antacids, and cough drops.

Read more: How to make your own DIY cruise first aid kit

How much does travel insurance cost?

Occasional travelers can purchase a single-trip policy directly through their cruise line.

Typically, policies run about 6% to 15% of the total fare. For example, if a family of four were to cruise aboard Royal Caribbean's Icon of the Seas in November 2025 in an inside cabin for about $4,600, the insurance policy would cost an extra $416 or 9% of the cruise fare.

While the benefits vary based on which line you're sailing with, you can expect trip interruption protection, baggage protection, medical protection, and emergency evacuation protection. Some may even include a clause that provides compensation for trip delays.

There are also annual policies for frequent travelers. They provide coverage for one year of travel, so you don't have to worry about adding policies on a trip-by-trip basis. These are ideal for those who travel more than 2 or 3 times per year, even if just one of those vacations is a cruise.

Last year, I paid $280 for an annual insurance plan through Allianz. My "AllTrips Prime Plan" includes trip cancellation/interruption coverage, travel delay coverage, baggage loss/delay coverage, rental car damage and theft coverage, emergency transportation coverage, emergency medical/dental coverage, and travel accident coverage.

As someone who travels at least once per month, an annual policy made much more sense than adding individual policies to each of my trips. While I've never needed to file a claim, the small out-of-pocket price is worth the peace of mind should such an incident occur.