Imagine earning points to redeem exclusive rewards and perks on your upcoming cruise. If you're an avid traveler, opening a cruise line credit card might interest you.

Some of your favorite cruise lines offer credit cards, including Royal Caribbean and Carnival Cruise Line, which are issued through major banks.

But before you set sail with this card in hand, it is important to understand how these cards work and what they exactly offer.

Editor's note: Information was accurate at the time of publication. Perks, promotions, annual fees, and annual percentage rates are subject to change without notice.

Carnival Credit Card

Name: Carnival World Mastercard

Annual fee: $0

APR: 19.74% to 29.99% (based on creditworthiness; variable with prime rate)

Point accrual: 2 points per dollar spent with Carnival and sister brands like Holland America, Princess, and Cunard; 1 point for every dollar spent on other purchases; no point maximum or expiration

Per-point value: $0.01

Redeem for: statement credit, gift cards, onboard purchases, and cruise bookings

Example perks and promotions:

- No interest for 6 months on cruise bookings made with the card

- 30,000 FunPoints ($300 onboard credit) after spending $1,000 in the first 90 days

- No foreign transaction fees

- No interest for 15 months on balance transfers (fee applies) made within 45 days of card activation

Celebrity Cruise Credit Card

Name: Celebrity Cruises Visa Signature Card

Annual fee: $0

APR: 18.24% - 28.24% (based on creditworthiness; variable with prime rate)

Point accrual: 2 points per dollar spent with Celebrity and sister brands Royal Caribbean and Azamara; 1 point for every dollar spent on other purchases; maximum of 540,000 points per year; 5-year point expiration

Per-point value: $0.01

Redeem for: statement credits, onboard credit, cabin upgrades

Example perks and promotions:

- Online offer: 30,000 MyCruise Points ($300 on board credit) after at least $1,000 in purchases with the card within the first 90 days

- No foreign transaction fees

- Redeem points for onboard credit, stateroom upgrades, and cruise vacations on all lines within the Royal Caribbean Group: Celebrity, Royal Caribbean, and Silversea

- Contactless chip technology

Disney Cruise Line Credit Card

Name: Disney Visa Card and Disney Premier Visa Card

Annual fee: $0 (Standard Visa Card) and $49 (Premier)

APR: 18.24%- 27.24% (based on creditworthiness and other factors)

Redeem for: statement credit, cruise credit, theme park entry, dining, souvenirs, movie tickets, Disney Store purchases (both cards); flight credit (Premier Visa only)

Point accrual: Earn 1% in Disney Rewards dollars per dollar spent on all purchases (both cards); 2% in Disney Rewards points per dollar spent at restaurants, gas stations, grocery stores and most Disney locations; Earn 5% in Disney Rewards dollars on card purchases at DisneyPlus.com, Hulu.com, or ESPNPlus.com (Premier Visa only)

Per-point value: $0.01

Example perks and promotions:

- No interest for 6 months on select Disney vacation packages and Disney Vacation Club purchases

- Discounts on cruise bookings, theme park admission, and character experiences, as well as Disney shopping and dining

- $200 statement credit after spending $500 within the first 90 days of a new account (standard Visa only)

- $200 Disney Gift Card eGift to use upon approval; $200 statement credit after spending $500 within 90 days of new card activation (Premier Visa only)

Holland America Credit Card

Name: Holland America Line Rewards Visa

Annual fee: $0

APR: 19.24% - 29.99% (based on creditworthiness; variable with prime rate)

Point accrual: 2 Holland Points per dollar spent with Holland America Line; 1 point for every dollar spent on other purchases; no point maximum or expiration

Per-point value: $0.01

Redeemable for: statement credit, select cruise purchases when made online 15 days before embarkation, and certain gift cards and travel arrangements

Example perks and promotions:

- 20,000 points ($200 value) after spending $500 within the first 90 days

- Discounts on onboard purchases, such as spa treatments or items from the shops

- No foreign transaction fees

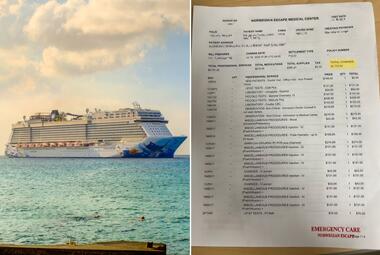

Norwegian Cruise Line Credit Card

Name: Norwegian Cruise Line World Mastercard

Annual fee: $0

APR: 18.24% - 28.24% (based on creditworthiness; variable with prime rate)

Point accrual: 3 WorldPoints per dollar spent with NCL; 2 points for every dollar spent on qualifying air and hotel purchases; 1 point for every dollar spent on other purchases

Per-point value: $0.01

Redeem for: stateroom upgrades, travel discounts, exclusive redemption opportunities for last-minute cruises, onboard credits, car rentals, hotel stays, cash and gift cards, and statement credits

Example perks and promotions:

- 20,000 WorldPoints ($200 value) when making $1,000 in purchases within 90 days of card activation

- No foreign transaction fees

Princess Cruises Credit Card

Name: Princess Cruises Rewards Visa

Annual fee: $0

APR: 19.24% - 29.99% (based on creditworthiness; variable with prime rate)

Point accrual: 2 points per dollar spent with Princess, including onboard purchases; 1 point for every dollar spent on other purchases; no point maximum or expiration

Per-point value: $0.01

Redeem for: statement credits, cruise rewards, onboard credits, special onboard amenities and discounted airfare

Example perks and promotions:

- 20,000 points ($200 onboard) after $500 in purchases within the first 90 days of opening an account

- No interest for 15 months on balance transfers made within 45 days of card activation

- No foreign transaction

Royal Caribbean Credit Card

Name: Royal Caribbean Visa Signature Card

Annual fee: $0

APR: 18.24% - 28.24% (based on creditworthiness; variable with prime rate)

Point accrual: 2 points per dollar spent with Royal Caribbean and sister brands Celebrity and Azamara; 1 point for every dollar spent on other purchases; maximum of 540,000 points per year; 5-year point expiration

Per-point value: $0.01

Redeem for: cruise upgrades and discounts, free cruises, onboard credit, and statement credit

Example perks and promotions:

- 30,000 MyCruise Points ($100 value) after spending $1,000 or more with the card within the first 90 days

- $50 airfare discount on Royal Caribbean's Air2Sea program after making at least $3,500 in card purchases within the first 90 days of account opening

- No foreign transaction fees

- Special rates and VIP status at select luxury hotels all over the world